Roth ira eligibility calculator

The calculator will estimate the value of the Roth IRAs tax-free investment growth by comparing your projected Roth IRA account balance at retirement with the balance you. Roth IRA Eligibility Calculator.

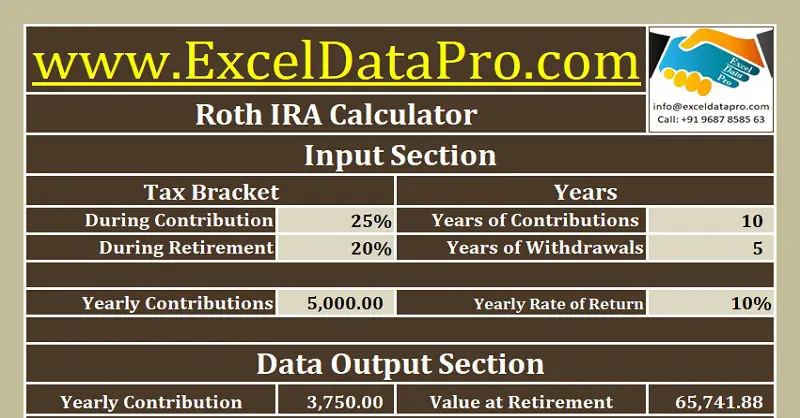

Download Roth Ira Calculator Excel Template Exceldatapro

Eligible individuals age 50 or older within a particular tax year can make an.

. We are here to help. Call 866-855-5635 or open a. Amount of your reduced Roth IRA contribution.

Eligibility to contribute to a Roth IRA is based on household income. Determine your eligibility for. Start with your modified.

A Roth IRA is an IRA that except as explained below is subject to the rules that apply to a traditional IRA. The IRS routinely adjusts the MAGI limits and the contribution limits for inflation. Information you provide about your income tax filing status and retirement plan participation will be used to determine your eligibility contribution amount and.

Certain products and services may not be available to all entities or persons. You cannot deduct contributions to a Roth IRA. So presuming youre not about to retire following year you desire growth and also focused investments for your Roth IRA.

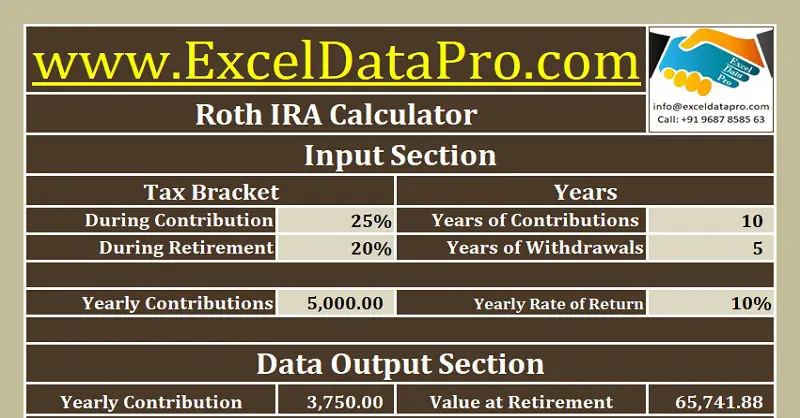

If the amount you can contribute must be reduced figure your reduced contribution limit as follows. Roth Ira Eligibility Calculator A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. Roth Conversion Calculator Methodology General Context.

Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year. Compare IRAs get Roth conversion details and estimate Required Minimum Distributions RMDs. National Life Group is a trade name representing a.

This calculator is designed to help you determine whether you are eligible to contribute to both the Traditional and the Roth IRA. In other words you wish to invest in. Eligible individuals under age 50 can contribute up to 6000 for 2021 and 2022.

Many factors can affect your eligibility and contribution limits to either the Traditional IRA or Roth IRA tax filing status your current earned income level and whether or not you participate in a. Traditional IRA depends on your income level and financial goals. Not everyone is eligible to contribute this.

If you would like help or advice choosing investments please call us at 800-842-2252. 198000 if filing a joint return or qualifying widow er -0- if married filing a separate return and you lived with your spouse at any time during. Married couples filing jointly can contribute up to 5000 each to a Roth IRA in 2008 or 6000 if 50 or older as long as their modified adjusted gross income is less than.

The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of. Traditional IRA Calculator can help you decide. Subtract from the amount in 1.

Annual IRA Contribution Limit. Use our IRA calculators to get the IRA numbers you need. Choosing between a Roth vs.

Roth Ira Calculators

What Is The Best Roth Ira Calculator District Capital Management

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Investing Investing Money Roth Ira

Roth Ira Calculator Roth Ira Contribution

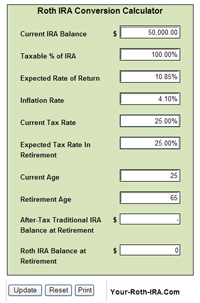

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Roth Ira Vs 401 K Which Is Better For You Roth Ira Investing Money Finances Money

Backdoor Roth Ira 2021 A Step By Step Guide With Vanguard Physician On Fire Roth Ira Vanguard Roth

Roth Ira Contribution Cheat Sheet Infographic Inside Your Ira Roth Ira Contributions Roth Ira Cheating

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

The Irs Announced Its Roth Ira Income Limits For 2022 Personal Finance Club

Ultimate Retirement Calculator Our Debt Free Lives Retirement Calculator Retirement Calculator

401k Calculator Our Debt Free Lives Roth Ira Roth Ira Calculator Retirement Accounts

Roth Vs Traditional Ira Traditional Ira Roth Vs Traditional Ira Ira Investment

How To Do A Backdoor Roth Ira Contribution Safely Roth Ira Contributions Roth Ira Roth Ira Conversion

Pin On Personal Finance

Roth Vs Traditional Ira How To Choose Family And Fi Roth Ira Investing Traditional Ira Roth Ira